Most people think of bartending as fast cash, big tips, and immeasurable amounts of fun, but when the IRS comes knocking, things can get serious very quickly.

Bartending is a popular and rewarding profession for those that have a passion for service and enjoy creating epic cocktails, but like any profession, they still need to comply with tax laws and obligations.

It’s a topic that is often overlooked and can become quite confusing, especially when taking into account the tips that bartenders earn on top of their wages.

While some people assume that bartenders are exempt from paying taxes or that their employer takes care of it, this is not always the case.

So, do bartenders pay taxes?

If this question has ever crossed your mind, stick around as we explore all there is to know about bartenders’ tax obligations and how they ensure they’re on the right side of the law.

Do Bartenders Pay Taxes?

Yes, bartenders are required to pay taxes on their income just like any other profession. Any income earned whether that is from tips or salary is considered taxable income by the government that needs to be reported on their tax return.

If bartenders receive more than $20 in tips per month, they are required to report this to their employer as tips are considered part of their wages and they’ll still need to pay payroll taxes on them.

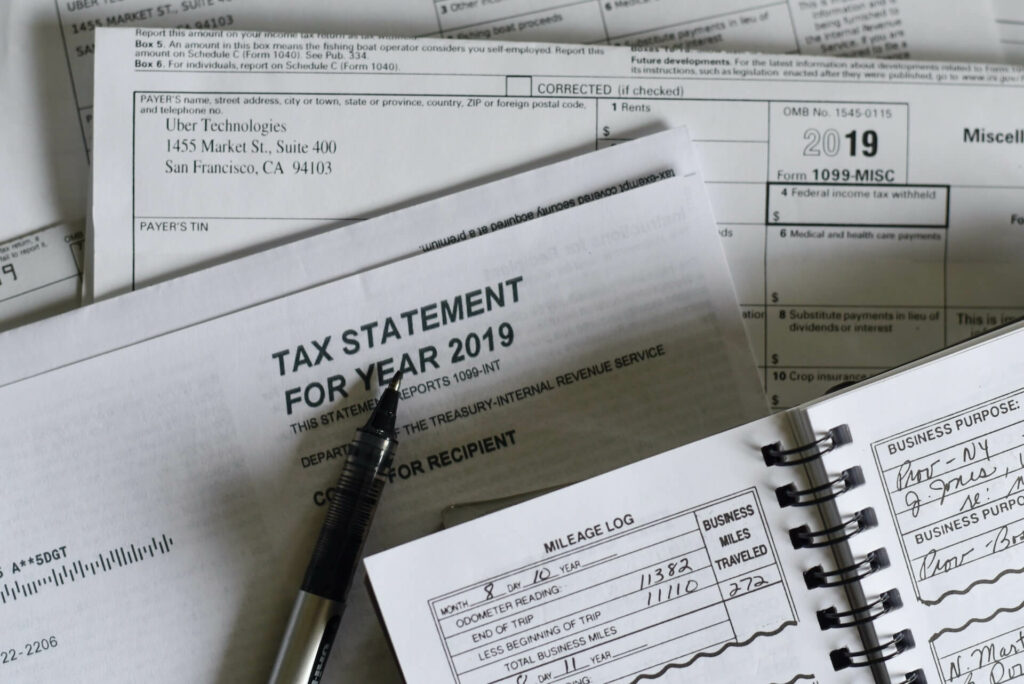

This is why it’s important that bartenders keep an accurate record of their earnings, including tips and any other forms of payment they may receive.

Failure to pay taxes on income earned can result in penalties and legal consequences, therefore, it’s important that bartenders understand their tax obligations to stay on the right side of the law.

>> Read more: How do bartenders get paid?

How To Record Tips Received

Keeping a record of tips received is very important for bartenders, the IRS likes to know EXACTLY how much they’ve received to ensure they are paying the right amount in taxes.

Thankfully, it’s not rocket science to keep an accurate recording of tips, just be sure that you’re logging it into your PC and keeping a physical copy on hand too.

When documenting tips earned, make sure to include the following;

- Date

- Location (if multiple establishments)

- Cash tips received

- Card tips received

How Do Bartenders Pay Taxes?

Most employers do withhold tax from a bartender’s paycheck to ensure they don’t owe too much in taxes at the end of the year, but ultimately, it’s the responsibility of the bartender to pay their own taxes on the income they’ve earned.

Employers are required to withhold federal income tax, social security tax, and Medicare tax from their employee’s paychecks, but bartenders are still responsible for reporting their income.

April 15th is the deadline day for most bartenders, this is when they are required to file their tax return which can be done either online or on paper but must include all income earned during the year.

Once filed, the IRS will calculate how much taxes are owed and then the bartender is responsible for paying their taxes.

The good news is that income tax and the other forms of tax will have already been paid as these have already been withheld from the employer, so in most cases, the tax bill won’t be crippling so long as it’s done correctly and legally.

Payment can be made through a variety of methods including credit cards, electronic payments, or mailing a check to the IRS, and you can pay either in a lump sum or installments.

How generous…

Most bartenders consult a tax professional before filing their tax return to ensure everything is in order, to do this, simply take your recorded tip earnings with you and they’ll help with everything.

Do Bartenders Pay Tax On Tips?

Yes, bartenders do pay tax on tips as it is part of their income and therefore must be reported on their tax return alongside their regular wages.

Bartenders need to pay income tax, social security tax, and Medicare on tips earned, which is why it’s important to keep an accurate log so these can be filed on the tax return.

Any tips that total $20 or more in a single month must be reported to the employer so that taxes can be paid on them.

It’s important to note that while bartenders are required to pay tax on tips, there are different regulations that apply to the taxation of tips depending on the state/country.

Some states require employers to withhold taxes from a bartender’s paycheck based on the tips they receive, and some states have different tax laws and regulations for tipped employees.

To ensure you’re above board when it comes to paying taxes on tips, I’d simply recommend keeping an accurate log of all tips received and consulting a tax professional before filing your tax return.

>>Read more: How much do bartenders in Las Vegas make?

Self Employed Bartenders

If you’re a self-employed bartender, the way you pay taxes is different from that of an employee as you’re responsible for paying all of your own taxes on income earned, as opposed to employers withholding tax.

Most self-employed bartenders would benefit from using tax calculation software which can make the process much easier.

Below are the steps to file taxes for self-employed bartenders:

- Determine your net income: Self-employed bartenders must calculate their net income by subtracting their deductible expenses from their total income.

- Report your income: Self-employed bartenders must report their income on their tax return using Schedule C (Form 1040), which is used to report income or loss from a business. This form is used to calculate the amount of self-employment tax and income tax owed.

- Pay self-employment tax: Self-employed bartenders are required to pay self-employment tax, which covers Social Security and Medicare taxes, on their net income. This tax is in addition to any income tax owed. Self-employed bartenders can calculate their self-employment tax using Schedule SE (Form 1040).

- Pay estimated taxes: Self-employed bartenders may need to make quarterly estimated tax payments to avoid underpayment penalties. Estimated taxes are paid to the IRS four times a year and are based on the amount of income earned and taxes owed.

- Keep records: Self-employed bartenders should keep accurate records of their income, expenses, and tax payments to ensure they are meeting their tax obligations.

Wrapping Up

To wrap up, YES, all bartenders must pay taxes on all earnings including tips, just like in any other profession and worker.

Whilst employers may withhold taxes from a bartender’s paycheck, it’s ultimately the responsibility of the bartender to file their tax return and pay the correct amount of taxes on their income.

Sadly, bartenders are not exempt from paying taxes and contributing to society, and ALL bartenders whether employed or self-employed have to face the dreaded taxman every year.

Thanks for taking the time to learn more about how bartenders pay taxes today, and If you are a bartender I would encourage you to scrub up on your knowledge on taxes to ensure you avoid any nasty penalties.

Catch you in the next one.